Investing in mutual funds through a Systematic Investment Plan (SIP) is one of the most effective ways to create wealth over time. SIPs enable investors to invest a fixed amount in a mutual fund scheme at regular intervals, ensuring financial discipline and long-term capital growth. However, to optimize investments and maximize wealth creation, it is essential to use the right financial planning tools. Two such tools that play a crucial role in investment planning are the SIP Calculator and the Step Up SIP Calculator. While both calculators help investors estimate future returns, using them together can provide better insights into wealth accumulation and help investors strategize their investments more effectively.

Understanding the SIP Calculator

A SIP Calculator is a financial tool designed to help investors estimate the future value of their mutual fund investments based on a fixed monthly SIP amount. It calculates the potential corpus an investor can accumulate over a period of time based on three key inputs:

- Investment Amount – The fixed amount invested every month.

- Rate of Return – The expected annual return from the mutual fund.

- Investment Duration – The total number of years the investment will be held.

Benefits of Using a SIP Calculator:

- Provides a clear estimate of investment growth over time.

- Helps in setting realistic financial goals.

- Assists in comparing different mutual fund schemes.

- Encourages disciplined and consistent investing.

While a SIP Calculator is useful, it assumes that the investment amount remains constant throughout the tenure. This is where a Step Up SIP Calculator comes into play.

What is a Step Up SIP Calculator?

A Step Up SIP Calculator, also known as a Top-Up SIP Calculator, helps investors estimate returns when they gradually increase their SIP contributions over time. Instead of investing a fixed amount each month, a Step Up SIP allows investors to increase their investment periodically—either by a fixed amount or a certain percentage annually.

This approach is particularly beneficial for salaried professionals and business owners whose income grows over time. Rather than sticking to a static investment, a Step Up SIP ensures that contributions grow in line with rising income, leading to higher wealth accumulation.

Benefits of Using a Step Up SIP Calculator:

- Maximizes Wealth Creation: By increasing SIP contributions, investors can generate significantly higher returns over time.

- Counters Inflation: A Step Up SIP helps investors maintain the purchasing power of their future corpus by adjusting investments for inflation.

- Aligns with Income Growth: As income increases, investors can afford to invest more without burdening their finances.

- Better Goal Planning: Investors can achieve long-term financial goals like buying a house, funding education, or retirement planning more efficiently.

Why Do You Need Both Calculators?

While a SIP Calculator is useful for estimating returns from a fixed SIP investment, a Step Up SIP Calculator provides a more realistic and dynamic projection of future wealth. Here’s why using both tools together is essential:

1. Better Financial Planning

A SIP Calculator gives a baseline estimate of how much wealth can be accumulated with a fixed monthly investment. However, a Step Up SIP Calculator helps investors understand how increasing their investment over time impacts their total corpus. By using both calculators, investors can make informed decisions about how to allocate their savings towards SIPs. For those starting with a small amount, exploring the best SIP plans for 1,000 per month can provide a solid foundation for long-term wealth creation.

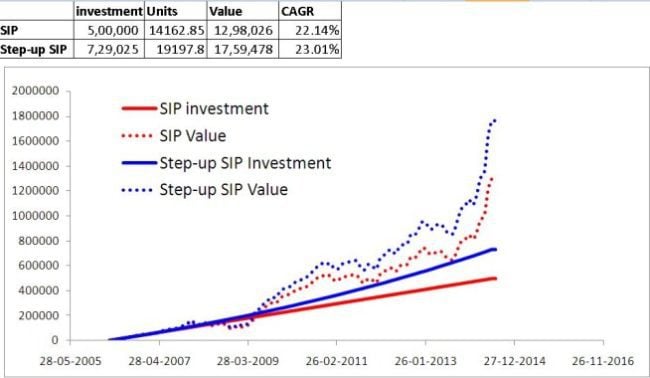

2. Higher Wealth Accumulation

Regular SIPs generate wealth through compounding, but a Step Up SIP significantly boosts returns by increasing investments at regular intervals. Using a Step Up SIP Calculator alongside a SIP Calculator allows investors to compare scenarios and choose a strategy that maximizes wealth.

3. More Realistic Projections

Most investors experience salary hikes, bonuses, or business growth over time. A Step Up SIP Calculator takes these factors into account, unlike a traditional SIP Calculator that assumes a fixed investment amount. Using both tools ensures that projections align with real-world income growth.

4. Flexibility in Investment Strategy

While a SIP Calculator provides a fixed roadmap, a Step Up SIP Calculator offers flexibility by allowing investors to adjust their contributions based on financial circumstances. This helps investors stay on track with their goals even if their financial situation changes.

5. Combating Inflation Effectively

A major drawback of a traditional SIP is that fixed investments might not keep pace with inflation. Over time, inflation reduces the purchasing power of money, potentially affecting financial goals. A Step Up SIP Calculator ensures that investments increase periodically, helping investors maintain the real value of their future corpus.

How to Use Both Calculators Effectively?

To get the best out of these financial tools, follow these steps:

- Start with a SIP Calculator:

- Enter a fixed monthly SIP amount you can afford today.

- Set an expected annual return rate.

- Choose the tenure of investment.

- Note the projected corpus.

- Use a Step Up SIP Calculator:

- Start with the same initial SIP amount.

- Enter the expected annual increase (percentage or fixed amount).

- Use the same tenure and return rate as before.

- Compare the new projected corpus with the SIP Calculator results.

- Analyze and Adjust:

- If the Step Up SIP shows significantly better returns, consider gradually increasing your SIP investments.

- Align the step-up increments with your expected income growth.

- Set a realistic and sustainable step-up percentage to avoid overburdening your finances.

Example Calculation

Let’s assume an investor starts with a monthly SIP of ₹5,000 for 20 years at an annual return of 12%:

- Using a Regular SIP Calculator, the estimated corpus would be ₹50.3 lakhs.

- Using a Step Up SIP Calculator (assuming a 10% annual increase in SIP contribution), the corpus would grow to ₹1.25 crores.

This example clearly shows that a Step Up SIP strategy leads to significantly higher wealth accumulation compared to a fixed SIP.

Conclusion

Both a SIP Calculator and a Step Up SIP Calculator are essential tools for making informed investment decisions. While a SIP Calculator provides a basic projection of fixed investments, a Step Up SIP Calculator helps investors understand how incremental contributions can lead to significantly higher returns.

By using both calculators, investors can:

- Plan their investments more effectively.

- Maximize their wealth creation potential.

- Align their SIP strategy with income growth.

- Protect their corpus from inflationary effects.

For investors serious about long-term wealth creation, combining the power of a SIP Calculator and a Step Up SIP Calculator is the best approach. This ensures a structured and flexible investment plan that adapts to financial growth, ultimately helping investors achieve their financial goals faster and more efficiently.