The global crypto market has entered a new era—one defined not by speculation, hype cycles, or chance, but by skill-based trading, advanced infrastructure, and scalable opportunities. Across continents—from Asia to Africa, Europe to Latin America, the Middle East to Oceania—millions of traders are turning to a powerful new model that removes the biggest barrier in trading: capital.

Crypto markets are open 24/7. They move fast. They reward precision, discipline, and timing. But even the most experienced traders hit the same wall: without a large account, results remain limited.

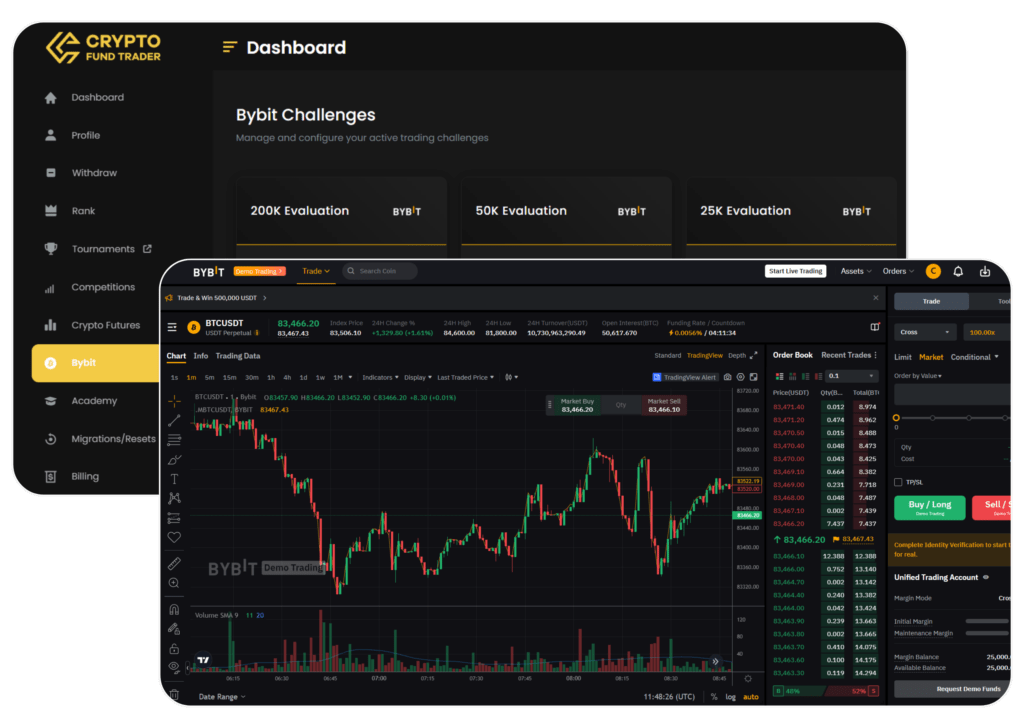

This is exactly why crypto prop trading firms https://cryptofundtrader.com/best-crypto-prop-firms/ have become one of the most influential and globalized trends of 2025. These firms provide traders with access to corporate capital—$25,000, $50,000, $100,000, or more—in exchange for passing a structured evaluation and following risk rules.

The model is simple:

- The firm supplies the capital

- The trader supplies the skill

- Profits are shared, with traders keeping the majority

Because of this growing opportunity, traders worldwide are asking the same question:

“Which is the best crypto prop firm for my strategy, my region, and my trading style?”

This article provides a complete global overview of:

- What crypto prop trading firms are

- How funded account challenges work

- Why the model has gone global

- Benefits and risks for traders anywhere in the world

- How to evaluate the best crypto prop firm in 2025

- Why traders trust research platforms like Crypto Fund Trader

- Where the industry is heading

Only two references appear once each:

cryptofundtrader.com

cryptofundtrader.com/best-crypto-prop-firms-usa

What Exactly Are Crypto Prop Trading Firms?

A crypto prop trading firm https://cryptofundtrader.com/ is a company that funds traders with the firm’s capital. Unlike traditional brokers, a prop firm doesn’t ask traders to deposit their own money. Instead, traders complete an evaluation challenge to prove:

- Their risk management

- Their consistency

- Their psychological control

- Their trading skill

If they succeed, they receive a funded account.

Typical process:

- Evaluation phase

Reach a profit target without violating risk rules. - Risk parameters

Stay within daily loss limits and overall drawdown thresholds. - Funded account

Use real capital provided by the firm. - Profit splits

Traders keep up to 80–90% of their generated profits.

This model allows a trader in any country—regardless of local economy—to access capital that would normally take years to build personally.

Why Crypto Prop Trading Firms Have Become a Global Movement

Crypto prop trading firms are not tied to geography. They do not depend on local banking systems, local regulations, or traditional finance infrastructure. They use global digital rails, crypto-based payout methods, and cloud-based trading platforms.

That makes the model universal.

Here are the global forces driving adoption.

1. Trading talent is global—not local

A trader in:

- India

- Nigeria

- Vietnam

- UAE

- Brazil

- South Africa

- Turkey

- Ukraine

- Indonesia

- Mexico

can be every bit as skilled as a trader in London or New York.

Prop firms break down the old barriers of geography and wealth.

2. Crypto markets run 24/7 across all world regions

Unlike stock exchanges, crypto never closes.

This allows:

- Asian traders to catch late-night volatility

- European traders to scalp overlapping sessions

- LATAM traders to swing-trade the U.S. market hours

- Middle Eastern traders to trade across two active sessions

Prop trading fits naturally into a 24/7 system.

3. Personal capital is no longer required

In many countries, it’s difficult or impossible to save thousands of dollars for trading.

Crypto prop firms eliminate this problem.

All traders need is:

- the challenge fee

- a trading strategy

- discipline

- consistency

This democratizes access to global opportunity.

4. Payouts are global and fast

Modern prop firms pay traders through:

- crypto USDT

- international wires

- global payment gateways

This means traders in ANY region can receive earnings quickly.

5. Prop structures improve discipline

The rules enforce:

- controlled risk

- consistent trades

- responsible leverage

- stable psychology

This is the opposite of emotional retail gambling.

How Evaluations at Crypto Prop Trading Firms Work

The evaluation system is designed to identify disciplined, consistent traders—not gamblers.

Here’s the core structure.

1. Profit Target

Common range:

8–10% for phase 1

5% for phase 2 (if applicable)

Some firms use simpler one-phase models.

2. Maximum Daily Loss Limit

If the trader loses too much in one day, the challenge ends.

This rule protects the firm AND trains trader discipline.

3. Maximum Overall Drawdown

Often 6–10%.

If the trader exceeds it, the evaluation resets.

4. Strategy Rules

Depending on the firm, rules may allow or restrict:

- scalping

- bots/EAs

- high-frequency trading

- hedging

- news event trading

- overnight positions

Choosing the best crypto prop firm depends heavily on which rules match your personal strategy.

5. Consistency Requirements

Some firms require:

- stable lot sizes

- controlled risk

- smooth equity curve

- no “one trade wonders”

This identifies long-term professionals.

After completing the evaluation, traders access real capital and make real payouts.

Benefits of Crypto Prop Trading Firms for Global Traders

This model offers huge advantages regardless of which country you trade from.

1. Large capital access without personal savings

This is the biggest advantage.

A skilled trader becomes a scalable trader.

2. You risk ZERO personal capital

Your savings are safe.

Your lifestyle is safe.

You risk ONLY the challenge fee.

3. High payouts

Most top-tier firms offer:

- 80%

- 85%

- 90%

profit share to the trader.

4. Traders gain discipline

Prop firm rules FORCE responsible behavior.

This alone improves results for many traders.

5. Global accessibility

You can trade from:

- Asia

- Africa

- Europe

- Middle East

- Latin America

- Oceania

All you need is:

- Internet

- Trading platform

- Strategy

No local finance system required.

6. It creates a REAL trading career

Prop trading is not a hobby—it is a scalable global profession.

Risks of Working With Crypto Prop Firms

Prop trading is powerful, but not perfect.

1. The evaluation can be stressful

Targets + rules = performance pressure.

2. Strategy restrictions may impact your system

Some traders need flexibility that certain firms don’t offer.

3. Not every firm is trustworthy

Some firms:

- manipulate rules

- delay payouts

- refuse withdrawals

- impose hidden conditions

This is why traders worldwide rely on cryptofundtrader.com for unbiased comparisons before choosing a firm.

How to Choose the Best Crypto Prop Firm (Global Criteria)

Here’s a universal checklist for selecting the right firm.

1. Fair rules

The best crypto prop firm will offer:

- achievable profit targets

- logical drawdown rules

- transparent evaluation steps

- realistic consistency criteria

2. Reliable global payouts

A top firm pays traders anywhere in the world quickly.

3. Strong execution and platform stability

Traders should look for:

- tight spreads

- low slippage

- stable execution

- solid trading platforms

4. Strategy compatibility

Your trading style MUST fit the firm’s rules.

5. Real reputation

Look for:

- real trader reviews

- payout proof

- community feedback

6. Scaling opportunities

The best firms expand capital over time:

- $50k → $100k → $200k → $500k → $1M

Why Global Traders Use Independent Research Hubs

With dozens of prop firms appearing every year, choosing the wrong one can waste time and money.

Independent research platforms like cryptofundtrader.com help traders:

- compare firms

- identify the safest options

- study rule structures

- avoid unreliable companies

- find strategy-friendly firms

Although it also provides regional guides such as cryptofundtrader.com/best-crypto-prop-firms-usa, the majority of its analysis is global and useful for traders everywhere.

The Future of Crypto Prop Trading Firms (Global Trends 2025–2027)

Several major developments are coming.

1. AI-powered trader evaluations

AI will analyze:

- risk behavior

- trade patterns

- consistency

- psychology

2. Institutional liquidity integration

This means:

- better fills

- lower slippage

- tighter spreads

- more stable execution

Across all regions.

3. More flexible evaluations

Expect:

- refundable challenge fees

- one-step evaluations

- unlimited time challenges

- instant funding models

4. Multi-asset expansion

Crypto prop firms will add:

- forex

- indices

- metals

- synthetic pairs

- commodities

5. Higher capital ceilings

Elite traders could soon manage:

- $500k

- $750k

- $1M or more

Final Thoughts: Crypto Prop Trading Firms Are Redefining Global Trading Careers

In 2025, crypto prop trading firms are no longer an experiment—they are the global standard for traders seeking scalable opportunities.

They:

- eliminate the need for personal capital

- offer large funded accounts

- reward disciplined trading

- create real careers

- work for traders everywhere in the world

But the true key to success is choosing the best crypto prop firm—one with fair rules, strong systems, and reliable payouts.

Independent analysis from platforms like Crypto Fund Trader gives traders worldwide the clarity needed to choose smartly in a crowded industry.

Funded trading is borderless.

Funded trading is skill-based.

Funded trading is the future.